COVID-19 has upended everything in our lives, and there is no end in sight to the disruption it has caused. After months of watching consumers change their shopping habits as well as a continued need to incorporate strict protocols around social distancing in physical spaces, designers must also face the challenge of evolving stores for the post-pandemic era.

New technologies that were already on the horizon and expedited during the pandemic are here to stay. Contactless payments, cashierless stores, robotic sales assistants — all manner of self-service technology will be integral to the in-store experience post-COVID. Physical stores must also provide a frictionless omnichannel experience with the help of innovations like virtual assistants, shoppable live streams, and improved visual- and voice-based product search tools that make shopping easier, more convenient, and more intuitive.

This kind of digital integration within stores will be essential, as will strategies for bringing brands into people's homes. The line between "physical" and "digital" no longer exists, and stores need to reflect that.

Below is a (not-so-brief) look at retail's new essential technologies.

Contactless Everything

In a post-pandemic world, retail will be largely contactless — not just over concerns around hygiene and safety, but also because of the increased convenience of digital everyone has come to embrace.

In a May 2020 survey from Capgemini, 73 percent of organizations expect consumers' skyrocketing preference for touchless transactions will persist even post-pandemic. For brick-and-mortar retailers that now have to attract customers who have become accustomed to shopping online from the comfort and safety of their homes, that means going fully contactless. As Forbes pointed out, "contactless" has become the retail industry's safe word.

In order to go fully "contactless," there are many high-touch areas for a retailer to address. But the biggest point of contact is the checkout lane, where much of the attention is currently focused.

Mobile Payments

Many major retailers have been developing their own apps for mobile payments to compete with the likes of Apple Pay for some time now. The celebrated Starbucks app is one example. There is also Chick-fil-A's ever-improving mobile ordering and payment app, and Kohl's mobile payment app that links to the chain's own credit cards, gift cards, and rewards program.

Mobile payments via native apps are among the digital-first strategies that were already being implemented by many retailers prior to the pandemic; the pandemic has simply sped up the process. Walmart quickly improved its "no-touch" Walmart Pay, their native app that first launched 2015, in response to the pandemic. Customers can now pay for their purchases in-store by scanning a QR code or ordering and paying for contactless curbside pickup directly through the app.

Kroger, the nation's largest traditional supermarket chain, launched its own mobile payment app last year, and is now testing a pilot program to accept a wide variety of other mobile payment options in order to attract as many customers as possible. So many retailers are now implementing some form of QR-based contactless tech that developer Seek has reported a 600 percent increase in usage since the pandemic started.

Contactless Shopping

But mobile payments alone do not eliminate the need to stand in line at the register, interact with a cashier, and carry home purchases touched and bagged by others' hands. Which is why some retailers are launching all-encompassing contactless apps.

The LoweBot in action

credit: Lowes

|

NYC's Showfields, already considered a "game-changer in brick-and-mortar retail," rapidly developed and released their app Magic Wand in the months since the pandemic began. This app allows customers to view product information, browse all products in the store without having to be near them, add the items they want to a virtual cart, pay through the app, and pick up their order at a designated point within the store without any contact or interaction with store staff.

There might also be an increased use of robotic sales assistants on the sales floor in the post-pandemic era. These assistants — like the LoweBot already in use at Lowe's and SoftBank's Pepper, which has successfully been used in a pilot at b8ta — can be used in a number of customer service capacities on the sales floor, cutting down on the cost of staffing as well as creating a safer environment with less human-to-human interaction.

The Cashierless Store

This kind of "checkout-free retail" involves scan-and-go technology, where customers use the retailer's mobile app to scan the products they'd like to buy, bag the items themselves, and pay via a QR code in the app as they leave the store. Despite relying heavily on the Honor's System, this scan-and-go technology has been in use at Sam's Club for years now, and more recently 7-Eleven has incorporated it into their operations.

A more sophisticated version of the cashierless store involves AI Computer Vision (AICV), which only requires customers to scan an app in order to enter the store. From there, they grab whatever they want off the shelves and leave without having to do anything more with the app; cameras and sensors do the rest of the work, and the customer is automatically charged for the items they took. Unsurprisingly, Amazon Go leads the pack here as the only U.S. retailer that has so far implemented such technology — their own proprietary "Just Walk Out" tech. But there will be additional comparably sophisticated versions of cashierless stores soon enough: Retail Dive reports that Standard Cognition's AI-powered automated checkout platform will be in "thousands of stores" by the end of this year. Convenience retailer, Circle K, is one of the first to announce it will soon begin retrofitting some of its stores with this exact technology.

Making Omnichannel Omnipresent

In the post-pandemic retail landscape, technology will play a significant role in every facet of the customer experience. The most obvious (and immediate) transformations to the customer experience will happen through contactless technologies, but tech will also be used to transform the way customers interact and engage with products in-store, and even at home.

As much as retailers want to get people back inside their physical stores, the stark reality is that it's not going to be the same as it was before. Omnichannel shopping is no longer just an added value: it is a non-negotiable essential for every retailer, and has already become a customer expectation. The line between physical and online shopping has been blurred for years now, and there is a need for both experiences to be seamlessly integrated. "Brands need to be nimble, agile, and responsive to shopper needs, and they need to deliver seamless, friction-free paths for their shoppers to navigate," Ray Hartjen, Marketing Director at RetailNext, told Tinuiti.

That kind of seamless integration includes a wide variety of different pathways, from ecommerce-enabled live streaming to sophisticated visual and voice search capabilities powered by machine learning.

Live Video Streaming

Live streaming allows brands to continue to connect and engage with their customers in meaningful ways even when they're not inside the physical store, with store associates streaming product demonstrations, sharing product information, and even acting as personal stylists.

China's department store chain InStore, owned by ecommerce giant Alibaba, uses TaoBao Live (Albiaba's own live streaming platform) to produce live streaming video sessions featuring their own sales associates. Customers can purchase directly from the live stream. In fact, live streaming was already a booming subsection of ecomm sales in China even before the pandemic hit, with "super hosts" (aka influencers) able to drive huge sales. Unsurprisingly, Amazon has also jumped onto the live streaming bandwagon with Amazon Live.

b8ta team members showcase products in a livestream

b8ta has been experimenting with live streaming during the pandemic, and plans to transform each store into a makeshift "production studio." In the UK, Brompton Bicycle launched Brompton Live In-Store Expert, a live video call service that connects customers to in-store staff live through the Go Instore video platform.

Perfect Corp.'s YouCam for Web is an AR platform that enables customers to test out a variety of cosmetics from different brands. They've partnered with a number of major health and beauty retailers, including Target, and include live streaming as one of the available features.

Startups like New York's The Call List can help facilitate influencer-led live streams for smaller brands via a simple browser plugin that connects customers through their Shopify ecommerce sites.

Virtual stylists and virtual assistants are another form of live streaming service, only with more one-on-one engagement. Suitsupply now offers a "co-browsing" online service in which sales associates walk customers through the brand's website in lieu of having in-store appointments. David's Bridal launched virtual stylist and virtual appointment services in late April in response to COVID closures. Brands like Stitch Fix, Allume, Lululemon, and even department stores like Neiman Marcus all offer similar virtual stylist services.

Visual + Voice Search + Other In-Home Initiatives

Visual search is another AR-powered retail trend that will become an essential part of an omnichannel strategy. Through visual search, customers can take a picture of an item they see out in the world and search for it online. Retailers will need to make sure their visual assets are high-quality and current to reap the benefit of this technology that we're already seeing used by Pinterest and Amazon. Wayfair, West Elm, and Target have also made visual search a big focus.

Voice-based commerce is a growing trend, thanks to the proliferation of home assistants like Alexa and Google Home — an NPR survey found that 60 million people now have at least one smart speaker system in their homes. The survey also found that the pandemic has led to increased voice tech usage by those with voice assistants, and Capgemini's survey found that 59 percent of consumers prefer to use voice interfaces to avoid physical contact. As this omnichannel pocket grows, retailers will need to develop their own voice ordering systems to integrate — examples of this already exist with Walmart's voice ordering service and 7-Eleven's 7NOW voice ordering.

Apart from these innovations, improvements in AR and VR tech means retailers will begin to rely more on these kinds of extended reality capabilities to assist with customers' shopping journeys outside the store. AR advancements will also enhance experiences within physical spaces. The "HoloRoom" of Lowe's Innovation Labs and virtual try on mirrors offer early glimpses of how the tech could evolve into a post-COVID future.

Brands are also beginning to devise products that extend their relationship with customers in a much more tangible way. Peloton's stationary bikes and treadmills take the studio into people's living rooms, while Lululemon's recent acquisition of exercise hardware startup, Mirror, also signals a shift in the role retailers could play in consumers' lives moving forward.

Automated Inventory

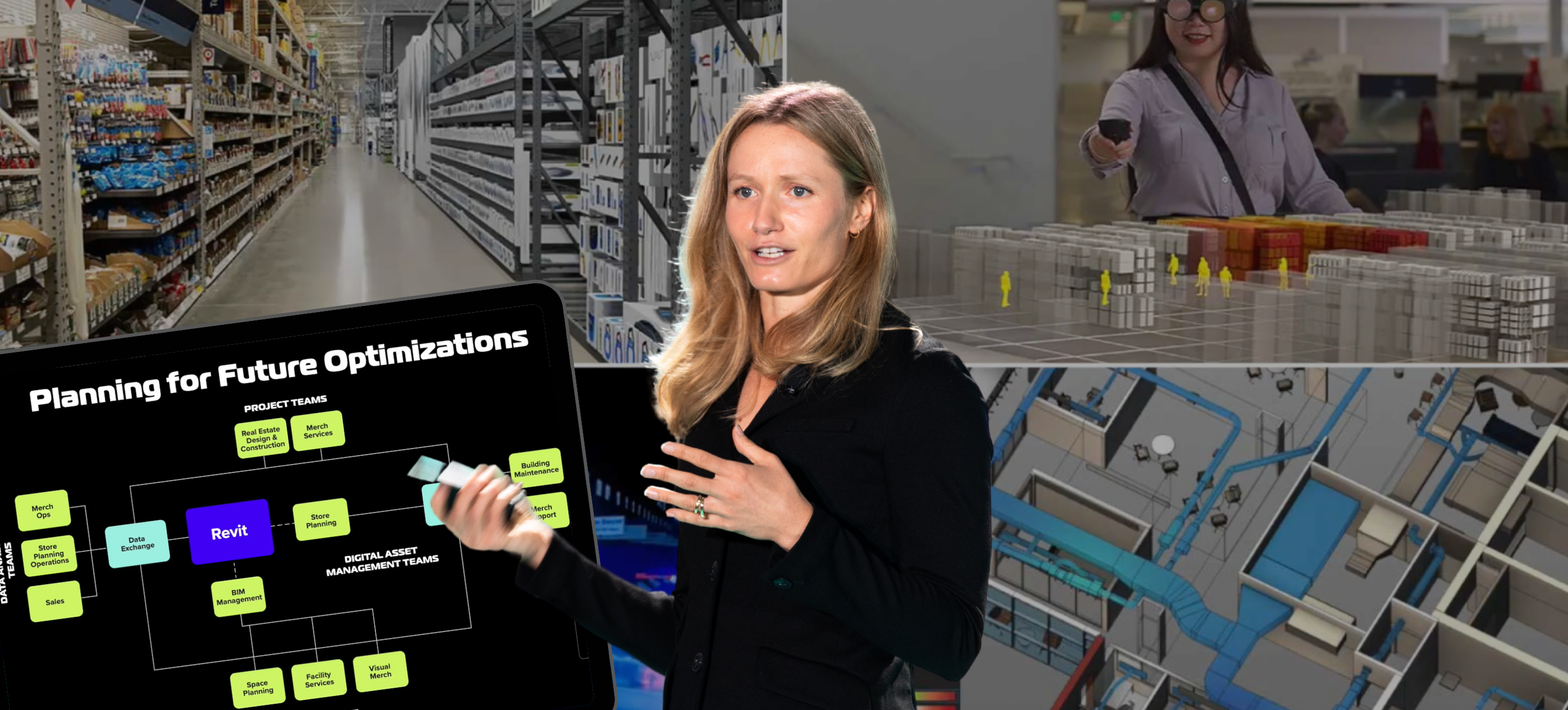

Real-time inventory accuracy is critical for an effective omnichannel strategy, and retailers will need to integrate their POS and ecommerce platforms so that transactions, inventory, and promotions are synced both on- and offline.

Behind the scenes, retailers will become even more dependent on technology for warehousing and order fulfillment. Research from Interact Analysis predicts that by the year 2025, more than 580,000 autonomous mobile robots will be deployed for order fulfillment, driven by factors that include the "Amazon Effect," the pre-pandemic labor shortage, post-pandemic safety concerns over warehouse working conditions, the increased cost of labor, and the continued ecommerce boom.

Major retailers will need to create micro-fulfillment centers within their own stores, and automation will be essential to keep these operations cost-effective. Automated warehouses will also significantly improve inventory management and give more accurate, real-time data through the use of aerial drones, AI-powered shelf-auditing robots, and safety robots. They also utilize technologies like sensor-enabled shelves and RFID to more efficiently manage inventory, as Lululemon has successfully done.

The Bottom Line: Get Busy Innovatin', or...

What 2020 did was take the inevitability of radical, sometimes uncomfortable change and condense it down to a period of several months, as opposed to a few years.

Huge increases in online shopping and BOPIS are just dramatic continuations of upward trends that were already taking place, meanwhile, reduced capacity and social distancing measures likely aren’t going away any time soon.

COVID was a call to action. If retailers aren't willing to accept the need for an utterly different way of seeing themselves and the reasons they exist, their future simply isn't assured.

Posted by

Physical Retail Reimagined.

RetailSpaces is a community for store development and design innovators.

March 29-31, 2026 | San Antonio, TX

Learn More!

Comments