After T-Mobile finalized its acquisition of Sprint in the spring of 2020, it converted 5,800 Sprint retail stores that summer. It was an impressive undertaking—especially given certain world-changing events occurring at the same time—and it was only the beginning of an even larger one. T-Mobile has spent the last two years going down to the studs and rebuilding those stores, integrating its own design and technology.

While the telecom giant is making steady progress, it’s nonetheless suffered the gamut of issues hindering retailers in this late stage of the Covid-19 pandemic. “Between supply chain and labor and inflation, we've had to manage through it,” said Jim Arca, T-Mobile’s Director of Construction. “It’s one roadblock or another that's been thrown out in front of us.”

What are the forces hindering store development today? How are companies dealing with them? To answer these questions, we spoke with Arca and John Morris, President of The Beam Team, a full-service general contractor.

Unpacking the Red Tape

One of the most nettlesome challenges retailers face is ongoing delays in permitting processes. The product of staffing shortages, remote work, and the virus itself interrupting already lengthy bureaucratic timelines, these delays can set projects back by months or longer. “We’ve had some jobs where it was a misspelling on the address or something like that, and then they have to go literally start over the process because of one little clerical error that occurred,” Morris said.

The delays may be getting shorter, but even short delays can wreak havoc. At T-Mobile, Arca saw an average permitting lead time of eight weeks reach 10 weeks, then as high as 14 weeks during the Omicron surge. “At the beginning of the year, we really weren’t getting permits,” he said. “It was taking 13, 14 weeks. We've seen that drop back now to where on average it's around 12 weeks, but we've never planned for that long in our timeline.”

To mitigate these interruptions, The Beam Team created a new position managing its permitting processes across the country. “It helps a lot,” Morris said, especially when it comes to competing against local contractors who enjoy a more familiar rapport with their local officials. “They [new role] kind of coach our field staff who might be dealing directly with somebody at the office, and just how you deal with permitting folks and get things done. We definitely felt it was worth the investment.”

Surviving Supply Chain Delays

Effective management of supply chain delays, much like effective management of the permitting process, requires coordination, communication, and foresight. Morris spoke to the need to make sure orders are clear and correct before they’re sent out, while stressing the importance of backup plans and secondary providers—especially, Arca added, for mission-critical materials.

Transparency with vendors is essential to dealing with unforeseen externalities, like staffing shortages on the shipping side. “What we’re finding a lot is it's not that the materials are missing, it's the drivers to get the materials there,” Morris said. “Just providing a lot of transparency and communication as to what the expectations are on delivery times and stuff like that is key.”

“Labor Availability is Terrible”

Labor issues continue to plague every level of the development pipeline. One counterintuitive problem Arca described is a raft of contractors filing for bankruptcy: even though there’s no shortage of work available, firms that didn’t prepare themselves for slowdowns earlier in the pandemic found their employees leaving for other work. “It's created a bit of an issue, where projects that normally take eight weeks have gone 10, 12, 14 weeks because our GCs are not there doing the work,” he explained. “Those that self-perform more work, and took advantage of the government programs, and kept their payrolls, and kept the people employed are in better position than those that probably didn't take advantage of all those opportunities.”

Morris was able to put the impact of higher labor costs in perspective with some statistics. Over a 12-month period, average pay rates for equivalent positions increased 6.3 percent, while temporary labor rates have increased 5 to 30 percent, depending on the area. Workers comp insurance went up more than 20 percent and health insurance has increased 12 percent. Overall, recruiting expenses have increased by over 200 percent.

He explained that at The Beam Team, they’ve discovered one shocking secret to withstanding the effects of the labor crisis: being good to work with. “We pay on time. We work really well with our contractor partners. That's important now, as things are moving so quickly—there are a lot of contractors that are tracking down their payments and things like that… We've seen good loyalty back from what we've provided over the years.”

“Just be good partners,” he continued. “Offer a lot of transparency. They're experiencing the same things we are with cost increases, so we're trying our best to be a partner and share in those cost increases with them.”

Investing in the Long Term

Internal hiring remains challenging as well. Even when a company manages to staff up, it might find itself burdened with untrained workers eager to leave at the earliest opportunity. “There's a lot more people getting into this industry, because it's a hot industry and there are high-paying jobs,” Morris explained. “And as they jump from job to job, they typically will find themselves getting pay raises because employers are trying to steal people.”

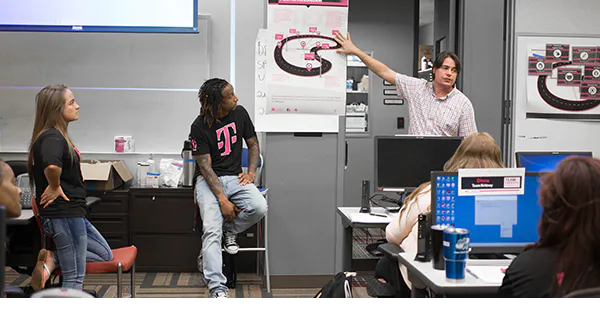

T-Mobile Internship Program

T-Mobile Internship Program

At the same time, he warned that employers who lure away their competitors’ employees end up shooting themselves in the foot. “If you're an employer, and you're trying to steal some people, you may throw some dollars at them,” he said. “But if your company doesn't have a good culture and you don't have good training, then these will be short-term employees. That word gets around. So I think people got over that pretty quick—you could go make some more money somewhere else, but it doesn't equal happiness and job satisfaction. It doesn't equal long-term career growth. So that's what we try and focus on.”

T-Mobile is especially interested in its employees’ long-term career growth. Recalling the rigorous training program he went through earlier in his career, at ExxonMobil, Arca lamented the dearth of comparable programs today. “When you talk to the schools that have construction management programs, they don't ever talk about the retail side of it,” he said. “They always talk about the general construction side of it, the industrial side of it, the commercial side of it, never the retail side.”

To remedy this, T-Mobile launched an internship program for students pursuing construction management degrees. “There’s a need for it and not a supply,” he said. “One of the things that I truly want to advocate is to spend more time trying to bring on more subject matter experts, through school, and then teach them more and mentor them in this space. Because there are truly not enough of them.”

Posted by

Physical Retail Reimagined.

RetailSpaces is a community for store development and design innovators.

March 29-31, 2026 | San Antonio, TX

Learn More!

-Feb-24-2026-11-55-37-9700-AM.png)

-Feb-23-2026-07-51-47-0561-PM.png)

Comments